Zero to one innovations, a terminology popularised by Peter Thiel, mark a Big Bang moment of inception that brings a new idea to life for the first time. Future innovations building on that are then simply iterations on top of a pre-existing idea. In reality, they are often less of a spark and more of a process, before their true potential is realised.

Zero to One: Notes on Startups, or How to Build the Future

Zero to One History

Most historical zero to ones are obvious in hindsight, though that doesn’t mean the ramifications of those ideas were understood at the time, nor what they would lead to.

From primitive tooling, to the ability to create and control fire. From weaponry, to boats and agriculture. From the humble wheel, to motorcars, to writing and the invention of the printing press. From electricity, to the Babbage computer, to the Internet. Zero to ones have transformed our lives, providing new categories of abundance from which to create value and conceive a better future.

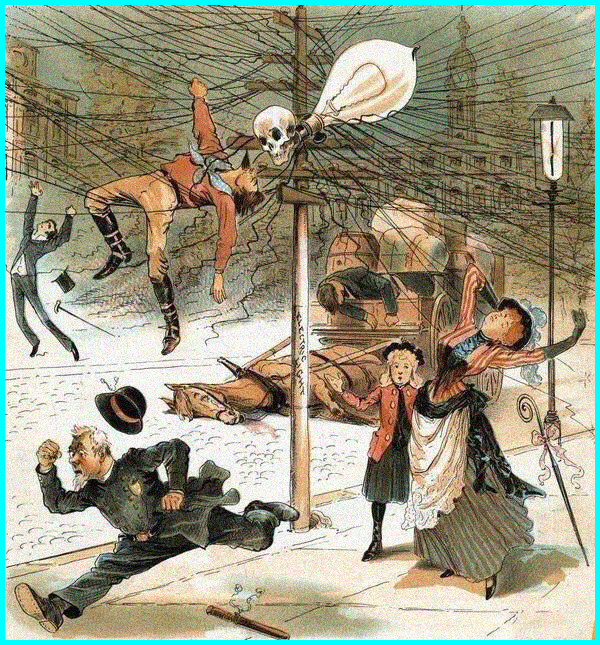

Most are sceptical of zero to ones at first. In 1889, electricity pioneers were decried as murderers.

The Unrestrained Demon

In 1878, some of the first motorcars had to travel behind red flag bearers, despite maximum speeds of 10 mph / 16 km/h.

Red Flag Act

Renowned Nobel Prize winning “economist” Paul Krugman, commented on the emerging Internet that:

“By 2005, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.”

Lol.

Nevertheless, just 2 decades later a significant proportion of the world interacts with the Internet every day of their lives for almost any imaginable need.

Then, on 31st October 2008, the latest zero to one idea was published: “Bitcoin: A Peer-to-Peer Electronic Cash System”. Money itself is a form of zero to one, allowing us to move away from an unscalable system of barter to a more common medium of exchange, store of value and unit of account. A game changer in the development of markets and economies. But if this is the case, why isn’t Bitcoin simply a future iteration on that zero to one idea?

Bitcoin:

A Peer-to-Peer Electronic Cash System

Zero to One Bitcoin

Though the invention of writing came before the printing press and electronic computer, that does not mean they were simply iterations of a better form of writing, they are zero to one innovations in their own right. And the same is true of Bitcoin.

Whilst money, of course, had existed in a variety of forms before Bitcoin, without fail, they had become centrally controlled, confiscatible and debasable. From the coin clipping Romans, to the perpetual inflation of modern fiat money supply, there were no decentralised, trustless and unconfiscatable alternatives that solved the Byzantine Generals’ Problem, until Bitcoin.

Roman Coinage

It is important to note, however, that Bitcoin, as opposed to alt coins, is the only zero to one in the space. As Thiel notes in his 2014 book, Zero to One: Notes on Startups, or How to Build the Future; each moment only happens once. In Bitcoin’s case, this was on 31st October 2008, or January 3rd 2009, depending on whether you mark this by the white paper release or the Genesis Block.

“The next Bill Gates will not build an operating system. The next Larry Page or Sergey Brin won’t make a search engine. And the next Mark Zuckerberg won’t create a social network. If you are copying these guys, you aren’t learning from them.

Of course, it’s easier to copy a model than to make something new. Doing what we already know how to do takes the world from 1 to n, adding more of something familiar. But every time we create something new, we go from 0 to 1. The act of creation is singular, as is the moment of creation, and the result is something fresh and strange.”

In the same vein, the “next Satoshi Nakamoto” will not create decentralised money. It’s possible to develop 1 to n iterations that may be incorporated into Bitcoin over time, however, presenting them as zero to ones and a new alternative to Bitcoin is misleading at best. These efforts are, therefore, misplaced - focusing on short-term money-grabbing fomo priorities, against the long-term building of value.

Interestingly, he also expands on the concept that progress comes from monopoly rather than competition, and that monopolies are actually good for innovation. Monopolists can focus on things other than making money, that competitors cannot. Fierce competition on the other hand forces a short-term focus on survival, rather than a long term plan for the future. This would seem contrary to a free market philosophy and one that is damaging to the rest of society. And, yes, that would be true in a world where nothing changes, allowing such a monopoly to simply become a rent collector.

Thankfully, the world we live in is a dynamic one. In this sense, monopolies are good for society as they mean you are doing something better than everyone else - they drive innovation. We can invent zero to ones, brand new things that did not exist before - creative monopolies that provide choice by delivering a new category of abundance to the world and a powerful vehicle to make it a better one. They are the fastest horse in the race.

Monopoly

Rivalry, however, causes us to copy the past. Those frustrated by their differences, lack of understanding or influence within this new category, instead of using its potential to create abundance, seek to simply copy it, make arbitrary changes and present it as something new.

This is driven by sets of differing ideas or goals about what this new category should or shouldn’t be, and the greater the difference the greater the conflict. In the end, such rivalry causes an overemphasis on old opportunities, once the zero to one event has happened, slavishly copying what has worked in the past.

It is about dominating one niche at a time, building your creative monopoly, doing that thing better than anything else, to the point where you can expand into other relevant use cases over time.

We can see this quite clearly in this space, where Bitcoin is successfully dominating decentralised store of value. Over the long-term, this can then scale in the right way to further utility. Bitcoin’s creative monopoly has offered us a zero to one opportunity to create abundance from vertical progression.

It is a harder path, yes, but a better one. Instead, rivalries have led to a plethora of horizontal copycats selecting the easy path, rather than taking advantage of the opportunity of Bitcoin to build out additional layers to create value over the longer term. Success takes time, and Bitcoin provides the perfect platform for low time preference, creating greater value in our future than we have to today, and contrasting against a high time preference alternative of short-term priorities and financial gain.

If you are simply copying from Bitcoin, you aren’t learning from it.

Bitcoin created a decentralised system that truly cannot be copied, and that’s not a bad thing. It has no centralised figurehead or corporation. It benefits from a technological and monetary advance that was more than 10 times better than what came before. Alt coin iterations of Bitcoin cannot claim this. Its monopoly allows it to enjoy network effects, strengthening its power and usability over time.

Economies of scale from second layer and sidechain solutions are beginning to emerge and will increase in their importance. It has a strong “brand” that cannot be replicated, even if some try to include its name. Only Bitcoin is Bitcoin and all these factors help it to thrive. Ultimately, it would take another zero to one, likely hundreds of years into the future to displace it.

Satoshi had the ability to think outside of established conventions to see and change the future, backed by the skill, determination and focus to be the initial architect of it. There is only one best future, however. Attaining it requires a concerted effort - both initially to have the vision to strike when the conditions are just right, providing a solid foundation, then continuing in vigorous pursuit of that best future.

Satoshi nailed the timing, striking at a point of an awakening conscience following the onset of the previous financial crisis. The concerted effort since has been the responsibility of all Bitcoiners. At times, we have been found wanting, wondering from the path. As we now enter another period of global economic uncertainty, it is more important than ever that we stay the course in the pursuit of that best future.

Bitcoin is zero to one money. Seize the opportunity.

Bitcoin City

humanjets is an entrepreneur, writer, bitcoin miner and lightning surfer.